About GGC

George, Goldstein Co. has been serving the Philadelphia community for over 40 years.

George, Goldstein Company is a Philadelphia-based tax firm with over 40 years of Accounting experience. Our goal is to serve our community by acting as a bridge between our clients and the Government. By providing superior-quality tax, accounting, payroll, and financial consultative services, we assist members of our community to create their businesses, pay their taxes, pay their employees, feed their families, and ultimately work towards the American Dream.

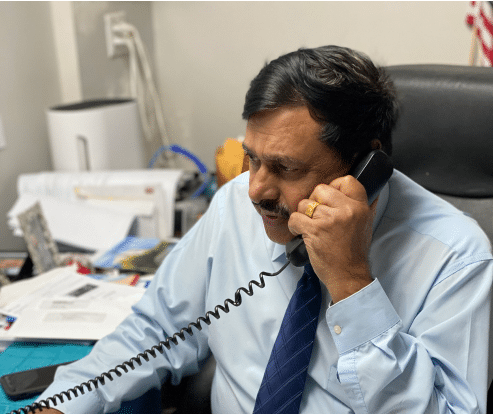

We represent our clients in all dealings with the IRS, including responding to communications and pursuing procedural and administrative remedies to attain the best outcome and relief for audits, etc. Even if you haven’t filed your taxes for a number of years, we can help get you back on track in restoring your financial security.

Our staff is committed to the success of our clients. We deliver the resources, expertise, and capability of a Big Four accounting firm together with the responsiveness and accessibility of a local partner. What started as just a man with a dream has become a successful full-service financial services firm that services clients nationally. Contact us today to speak to a financial professional about your needs.

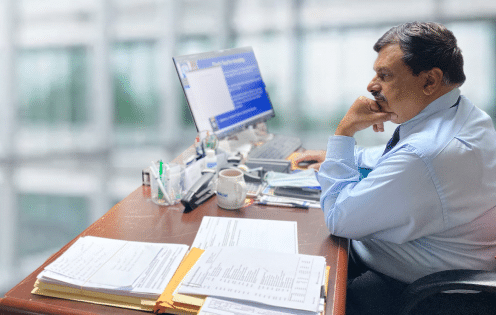

About George Mathew, CPA

George Mathew is a Certified Public Accountant and the president of George, Goldstein Company, which is located in the Northeast section of Philadelphia. He specializes in tax accounting for corporations, partnerships, LLCs and LLP’s, non-profit organizations, and the general public. Mr. Mathew is an award-winning facilitator with more than 40 years of successful experience as an accountant, tax preparer, regional manager, director, and national convention/event organizer. He is skilled in a comprehensive range of accounting, financial report preparation, budget creation and administration, payroll processing, and financial planning.

Outside of the indian community, Mr. Mathew has also held positions within the City Government of Philadelphia. He served as a member on the Commission of Human Relations (5 years) and Asian-American Affairs (4 years) in Philadelphia. He has also served as a commissioner on Governor Edward G. Rendell’s Advisory Commission on Asian-American Affairs in the State of Pennsylvania, and member of the Commission on Mayor Michael Nutter’s Advisory Commission on Asian-American affairs in the City of Philadelphia. He continues to serve on many boards in the Philadelphia area.